How a €20,000 Renovation Drove a 12.14% Net Yield for a Lagos Investor

Key Takeaways

A €115,000 Lagos Old Town purchase required €20,000 in comprehensive renovations to reach rental-ready condition, bringing total investment to €140,000 (including taxes and purchase fees)

Post-renovation valuation reached €210,000, creating €70,000 in equity gain (50% increase on total investment) before generating any rental income

The property achieved 12.14% net annual rental yield through strategic design decisions focused on vacation rental appeal rather than traditional residential finishes

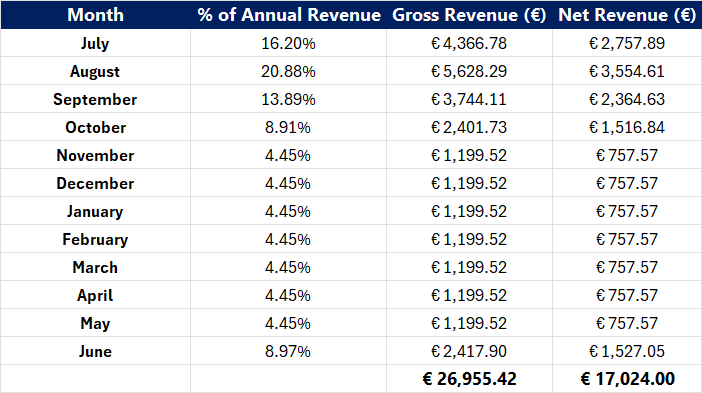

Monthly revenue distribution shows clear seasonality with August peak (21.01% of annual revenue) and November-May lows (4.49%), demonstrating the importance of off-season positioning

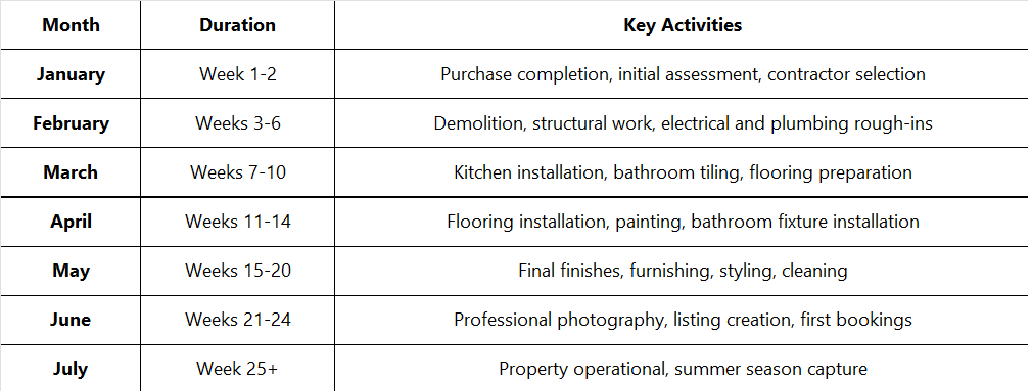

Six-month renovation timeline from January to June positioned the property for immediate summer season capture, maximizing first-year returns

Want to see what your rental property in the Algarve should actually be earning?

Click here to get your free earnings estimate using real Algarve market data.

When our client purchased a two-bedroom apartment in Lagos Old Town for €115,000, the property was uninhabitable — peeling walls, mouldy kitchen, damaged bathrooms, and electrical systems requiring complete replacement.

In short, the kind of renovation project we dream of at Casa Oeste, and that which delivers maximum returns for investors.

None of the complex and time-consuming headaches of a knock-down rebuild, but in enough of a state that most amateur and part-time renovators would be scared off by the estate agents listing.

Six months and €20,000 in renovations later, the property achieved a post-renovation valuation of €210,000, and in the year that followed, a 12.14% net annual rental yield.

This isn't a theoretical ROI projection. This is actual performance from a completed renovation managed by Casa Oeste, demonstrating how strategic renovation investment drives measurable returns in the Lagos rental market.

The Starting Point: Lagos Old Town Opportunity

Lagos Old Town represents one of the West Algarve's most desirable rental locations. Properties within the historic center offer walkability to restaurants, bars, and marina access while maintaining proximity to beaches and tourist infrastructure.

We identified a two-bedroom apartment requiring substantial renovation. The €115,000 purchase price reflected the property's condition - this wasn't a cosmetic refresh opportunity, but rather a complete transformation project - but a bargain nonetheless, given the potential returns.

Initial property condition:

Kitchen: Severe mold, damaged cabinetry, non-functional appliances

Bathrooms: Outdated fixtures, poor waterproofing, ventilation issues

Walls: Extensive peeling paint, water damage, structural repairs needed

Flooring: Damaged tiles requiring complete replacement

Electrical: Systems requiring full replacement to meet current standards

Plumbing: Comprehensive updates needed throughout

The property was clearly nowhere near listable on rental platforms in its acquired condition. Rental income generation required completing renovations first, creating a six-month window before revenue could begin.

Renovation Strategy: Design for Rental Performance

Our renovation approach prioritized features that drive short-term rental bookings and justify premium rates rather than traditional residential finishes that add cost without improving rental performance.

Kitchen Transformation

The original kitchen was non-functional. Complete demolition preceded a full rebuild focused on short-term rental requirements.

Design priorities:

Clean, bright aesthetic with white cabinetry maximizing light

Wood-effect countertops providing warmth and character

Open layout connecting to living/dining area

Sufficient storage for vacation rental provisions

Modern appliances meeting guest expectations

Natural material accents (hanging plants, wood elements)

Budget allocation: Approximately €6,000 including demolition, cabinetry, countertops, appliances, plumbing, and electrical work.

The kitchen became a lifestyle feature in listing photos rather than just functional space. This positioning justified higher nightly rates by appealing to guests seeking quality accommodation rather than basic lodging, but we needed an ROI balance, which was achieved through strategic sourcing — IKEA cabinetry provided the clean, modern aesthetic guests expect without premium material costs.

Short-term rental guests don't need or expect restaurant-grade appliances or custom carpentry; they book spaces that photograph well and leave high reviews for spaces that function reliably.

Bathroom Renovation

The bathroom required complete reconstruction. Rather than replicating Portuguese traditional design (done-to-death in most Portuguese Airbnbs), Casa Oeste implemented modern, minimalist finishes that photograph well and meet international guest expectations.

Design elements:

Walk-in showers with glass enclosures (no bathtubs)

Wall-mounted fixtures creating clean lines

Bright white finishes maximizing perceived space

Quality fittings suggesting premium positioning

Proper ventilation preventing future moisture issues

Budget allocation: Approximately €4,000 including demolition, new plumbing, waterproofing, tiling, fixtures, and installation.

Bathroom quality disproportionately impacts guest reviews. Guests tolerate many property limitations but consistently penalize bathroom issues. This renovation phase received proportional budget attention recognizing its review score impact.

Living Areas: Open-Plan Transformation

The apartment's original layout featured a separate, enclosed kitchen—typical of traditional Portuguese residential design where small, divided rooms are the norm. We knocked out the wall separating the kitchen from the living and dining area, creating an open-plan layout.

Design decisions:

Wall removal creating kitchen/living/dining flow

Wood-effect vinyl flooring throughout (not traditional tile)

White walls creating bright, airy atmosphere

Minimal furniture allowing space perception

Natural light maximization through window treatments

Budget allocation: Approximately €6,000 for wall removal, flooring, painting, lighting, and structural finishing work.

The wall removal was the most important design decision in the entire renovation. Modern short-term rental guests, particularly from the UK and Northern Europe, expect open-plan living spaces. Traditional Portuguese layouts with multiple small rooms feel dated and claustrophobic to international markets.

Open-plan layouts photograph dramatically better—listing photos show the entire living area in single shots rather than disconnected fragments.

Wood-effect vinyl provided visual warmth that international guests expect while withstanding vacation rental wear without the maintenance complexity of genuine hardwood or the cold aesthetic of tile.

Bedrooms, Furnishing and Styling

We furnished the property specifically for vacation rental performance rather than personal taste or traditional Portuguese residential standards.

Furnishing principles:

Light-colored, durable fabrics (easy cleaning, photograph well)

Minimalist aesthetic avoiding visual clutter

Natural materials (wood, linen, ceramic)

Strategic accent colors (orange chair)

Practical storage solutions for guest belongings

Quality mattresses (guest comfort = review scores)

Budget allocation: Approximately €4,000 for complete furnishings including beds, sofas, dining table, occasional furniture, kitchenware, linens, and decorative elements.

The furnished property photographs as a cohesive lifestyle product. This presentation quality directly impacts booking conversion rates—guests choose properties where they can envision their vacation experience.

Investment focused on photography-ready presentation and comfort fundamentals rather than luxury pieces that inflate costs without improving guest satisfaction or review scores.

Financial Performance: The Numbers

High-Level Investment & Yield Summary

Total investment breakdown:

Purchase price: €115,000

Taxes and fees: €5,000

Renovation costs: €20,000

Total investment: €140,000

Post-renovation outcomes:

Property valuation: €210,000

Equity gain: €70,000 (50% increase)

Yield summary

Gross Annual Revenue: €26,955

Casa Oeste Management Fee (25%): €6,738

Maintenance Reserve (5%): €1,347

Annual Utilities: €1,307

IMI (Property Tax): €487

Insurance: €49

Total Fixed Annual Costs: €1,845

Total Operating Costs (Variable + Fixed): €9,931

Net Income: €17,024

Net annual rental yield: 12.14%

Cleaning and linen costs passed directly to guests. Net annual rental yield represents actual cash-on-cash return to the owner (€17,024 annual net income on €140,000 total investment), not gross revenue projections.

Monthly Revenue Distribution and Winter Rental Strategy

The year 1 monthly revenue breaks down as follows:

NB: The annual revenue % figures are highly representative of all of our management properties.

Understanding the Winter Rental Model

The November-May period (31.15% of annual revenue, €5,303 net total) represents a single seven-month winter rental rather than individual short-term bookings. This is a critical distinction for Algarve vacation rental economics. Winter rentals in the Algarve typically run November through March-May.

Why Winter Rentals Matter More Than the Numbers Suggest

That €5,303 from a single seven-month booking is actually more valuable than it appears:

Occupancy certainty: Guaranteed income for seven months eliminates the risk of booking gaps that plague shoulder-season short-term rentals. March, April, and May short-term bookings often generate little more revenue than a winter rental due to lower nightly rates and occupancy gaps, while requiring substantially more management effort.

Reduced guest-related costs: Winter tenants generally treat the property as a temporary home rather than a hotel. This reduces your maintenance and supply costs.

The hidden costs of winter operations: Winter guests require heating, higher utility consumption, and property adaptations that four-night August guests don't need. However, spreading these costs across a single seven-month tenant is more predictable than absorbing them across multiple short-term bookings with gaps in between.

Why Owner Use in November-December Is Costly

The conventional wisdom suggests owners should use their property during the lowest-revenue months (e.g., November/January at 4.49% respectively). However, this logic ignores that these months are part of a €5k single booking.

Taking the property for personal use in November-December doesn't only sacrifice the potential revenue generated by the 1, 2, or 3 weeks that you might be using your property —it sacrifices the entire €5k winter rental because most ‘snowbirds’ (winter rental tenants) do not want to start a winter rental in January. Most winter tenants book complete winter periods, and it’s much less common to book partial mid-season arrangements.

We generally recommend owners use alternate accommodation wherever they can, because it generally costs less than you’ll make from your own property, but if you want to use your own, strive for personal use during shoulder season (April-May, or October outside of Northern European school holidays) when it only impacts shoulder-season short-term bookings rather than jeopardising a multi-thousand-euro single contract.

Strategic Maintenance Timing

Property maintenance and renovations should be scheduled for the first week after the winter rental ends. This timing:

Allows the full winter rental to proceed uninterrupted

Provides a natural transition period before peak summer season

Ensures the property is refreshed and ready for highest-revenue months (July/August)

Peak Season Economics

July and August combine for 37.08% of annual revenue (€6,313), representing the highest-value period requiring maximum property presentation quality. This figure is representative across our full Algarve portfolio.

However, this summer concentration shouldn't overshadow the winter rental's importance — €5k from a single contract with minimal operational burden provides the cash flow foundation and minimises losses that makes peak-season optimization worthwhile.

The revenue distribution informs operational priorities at our end:

Secure winter rental bookings by September

Schedule post-winter maintenance for the transition

Maximize July/August performance through optimal pricing and property condition

Maintain competitive shoulder-season positioning (June, September, October) without sacrificing winter rental opportunities

What Drove the 12.14% Yield

The achieved yield resulted from multiple factors working together rather than single decisions.

Location Selection

This apartment is located in Rua Miguel Bombarda in the Lagos Old Town, which provides walkability to restaurants, bars, and marina, and just steps from Praia da Batata beach.

This location commands premium rates year-round because it serves multiple guest demographics—summer families, shoulder-season couples, winter long-stay visitors.

Properties requiring car usage for daily activities generally compete at lower rate levels. Walkable locations capture rate premiums that compound across 365 days annually.

Design for Photography

Every renovation decision considered how the space would photograph.

Airbnb research shows properties with professional photography earn 28% more bookings, making visual presentation critical to performance.

The renovation created numerous "photogenic moments"—the styled kitchen, minimalist bedrooms with natural light, clean-lined bathrooms.

These images drive listing clicks and booking conversions.

Quality Over Luxury

The renovation budget focused on quality fundamentals rather than luxury finishes, which most short-term, Airbnb guests don’t expect.

Comfortable mattresses, durable furniture, reliable plumbing, and effective climate control matter much more to guest satisfaction than marble countertops or designer lighting.

This approach maximizes review scores without inflating renovation costs. Review scores directly impact future booking rates—maintaining 4.8+ star ratings requires quality fundamentals executed well.

If you’re renovating for short-term rentals, IKEA and Jysk can fulfil most of your needs.

Positioning for International Guests

Even though numbers of Portuguese travellers in the Algarve are high, international visitors spend way more, so the renovation addressed international guest expectations specifically.

Design elements resonating with international travelers:

Modern, minimalist aesthetic (not heavy Portuguese traditional)

Walk-in showers (international preference over bathtubs)

Open-plan living (contemporary European standard)

Quality WiFi and modern amenities

English-language welcome materials and communication

This positioning captured a large, predictable demographic with clear preferences and consistent booking patterns.

Timeline: Six Months to Rental-Ready

The six-month timeline positioned the property for immediate July/August revenue capture—the highest-earning months representing 37% of annual income. Starting operations in November would have sacrificed these peak months, reducing first-year returns by approximately 35%.

Renovation timing matters significantly for short-term rental ROI in your first year. Properties completing renovations entering peak season capture immediate high-value revenue. Properties finishing renovations entering low season face months of minimal income before peak demand returns.

Lessons from This Renovation

Lesson 1: Purchase Price Is Only Starting Point

The €115,000 purchase price seemed attractive, but required €20,000 additional investment before generating any income. Total capital deployed was €140,000, not €115,000.

Many investors make purchase decisions based on acquisition price without accurately budgeting renovation requirements. This creates cash flow problems mid-project or results in incomplete renovations that underperform rental expectations.

Realistic renovation budgeting before purchase prevents these issues.

Lesson 2: Design Decisions Have Measurable Revenue Impact

The choice to install walk-in showers rather than bathtubs saved approximately €1,200 per bathroom while better serving target guests.

The decision to use lino flooring instead of tile saved approximately €2,000 and created significantly better photography and guest perception.

Every material and design choice should consider its impact on listing photography, guest reviews, and operational maintenance.

Renovation is product development for the rental market, not just construction.

Lesson 3: Location Justifies Investment

The Lagos Old Town location allowed premium pricing that justified the renovation investment.

A similar €20,000 renovation in a less desirable location might not generate sufficient rate premiums to achieve 12.14% yields.

Renovation investment should align with location potential. Properties in prime locations warrant higher renovation budgets because they'll capture commensurate rate increases. Properties in secondary locations require budget discipline because rate ceilings limit renovation ROI.

Lesson 4: Timeline Management Impacts First-Year Returns

Completing renovations by June captured €15,000+ in July/August revenue. Finishing renovations three months later would have sacrificed this income, reducing first-year yields substantially.

We got lucky with contractor availability on this project, and although we do have an in-house team for many tasks, we do use contractors, and it’s common in the Algarve for contractors to give waiting times of 2-3 months, not days. Factor this in.

Renovation project management directly affects financial returns. Contractor reliability, material availability, and decision-making speed all impact when properties reach operational status.

Lesson 5: Comprehensive Renovation Reduces Ongoing Issues

This renovation addressed all systems completely—electrical, plumbing, structural, finishes. While more expensive upfront, this approach minimizes ongoing maintenance disruptions that damage guest experiences and review scores.

Partial renovations or deferred maintenance create ongoing problems that compound. Guest complaints about property issues reduce review scores, which reduce future bookings, which reduce revenue and yield calculations.

Are These Numbers Replicable?

This was undoubtedly a high-performing project, and the investor got lucky with many factors, not least: finding an undervalued property with incentivised sellers, contractor availability, and the timing of the market, but these opportunities still exist, and there are some rules you can adhere to to improve your yield.

Factors working in this renovation's favor:

The purchase price was incredibly low / undervalued

Lagos Old Town location (premium rental area)

Low purchase price relative to post-renovation value

Six-month timeline capturing peak season immediately

Strong international visitor demand to Lagos

Professional renovation management avoiding costly errors

Factors that made this project challenging:

Property required complete systems replacement (not cosmetic refresh)

Six-month no-income period during renovations

Total capital requirement of €140,000 (purchase + fees + taxes + renovation. Many properties which are deemed ‘uninhabitable’ in Portugal unfortunately are also ‘unmortgageable’)

Renovation experience needed to avoid budget overruns

However, the fundamental approach remains valid: identify undervalued properties in strong rental locations, execute comprehensive renovations focused on rental performance rather than residential standards, and position properties for target demographics that drive year-round demand.

Working with Casa Oeste

Between our partners and ourselves, we managed this renovation from purchase consultation through ongoing property management. The client needed a partner who could:

Assess renovation requirements accurately before purchase

Manage contractor relationships and quality control

Make design decisions optimising rental performance

Complete renovations on schedule for peak season

Handle professional photography and listing optimization

Provide ongoing management generating solid net yields

This comprehensive approach delivered results that self-managed renovations rarely achieve.

Professional renovation management prevents common errors that consume budgets without improving performance, ensures timeline adherence for seasonal capture, and applies rental market expertise to design decisions.

The €20,000 renovation could have cost €15,000 with budget materials and DIY management, but the resulting property would photograph poorly, appeal to fewer guests, command lower rates, and generate reduced yields.

Your renovation project manager needs to deeply understand tourism, short-term rentals, geographic variations in consumer demands, and hospitality. Most don’t. We do.

The additional €5,000 investment in quality materials and professional management paid for itself many times through improved revenue performance.

Conclusion

This Lagos Old Town renovation demonstrates how strategic investment in undervalued properties generates measurable returns through comprehensive renovation focused on vacation rental performance.

The €20,000 renovation investment transformed an uninhabitable €115,000 purchase into a €210,000 property generating 12.14% net annual yields. This performance resulted from location selection, renovation quality, design decisions prioritizing rental appeal, and professional management optimizing ongoing operations.

As an investor, you need to identify properties in strong rental locations, execute comprehensive renovations addressing fundamentals that drive guest satisfaction, position properties for target demographics, and manage operations professionally to capture optimal performance - but of course we can help you with that.

Casa Oeste specializes in renovation-focused property acquisitions for West Algarve investors. Between ourselves and our partners, we provide purchase consultation, renovation management, design guidance, and ongoing property management delivering results like this 12.14% net yield.

As a property owner in the Algarve, there are plenty of both mistakes to avoid and factors that can increase your revenue, from dynamic pricing to implementing guest communication systems, but visual presentation quality really determines whether guests view your listing or scroll past to competitors - we’re here to help with it all.

If you want to explore renovation opportunities in Lagos or other West Algarve locations, contact us to discuss your investment objectives and identify properties with similar yield potential.

Frequently Asked Questions

-

Market conditions are changing rapidly, and we did this renovation in 2021 — purchase prices are increasing and renovation costs have risen. That said, nightly revenue rates and average annual occupancies have risen too, the Algarve tourism market goes from strength-to-strength, and 10-12% net yields remain achievable with the right combination of location, renovation strategy, and management.

Success requires realistic budgeting, renovation expertise, and professional management to capture optimal performance.

-

In order of importance:

Kitchen and bathroom quality—guests scrutinize these spaces and penalize deficiencies in reviews

Photography-ready design—visual presentation drives booking conversion

Comfortable beds and quality linens—directly impact guest satisfaction and reviews

Reliable systems—plumbing, electrical, climate control failures create negative reviews

Natural light and bright finishes—properties that photograph well command higher rates.

Luxury finishes like marble countertops provide minimal yield improvement compared to these fundamentals.

-

This Lagos property gained €70,000 in equity through renovation (€120k purchase + fees + €20k renovation → €210k valuation) before generating any rental income.

Whether to sell immediately or hold for rental income depends on your investment goals and cash needs. The 12.14% net yield represents attractive cash-on-cash return if you can afford to hold the property long-term.

Selling captures equity gain immediately but sacrifices ongoing income. Consider holding period, capital requirements, and whether you want active rental management involvement.

-

Extremely important. This renovation completed in June captured 37% of annual revenue in July/August immediately. Finishing renovations in November would have faced five months of low-season income before accessing peak summer revenue.

For short-term rentals in seasonal markets, renovation timeline planning should target completion 1-2 months before peak season starts. Even delaying completion by one month can sacrifice €3,000-€5,000 in first-year revenue for typical properties.

-

Self-managing comprehensive renovations from outside Portugal presents significant challenges: contractor communication barriers, quality control issues, material selection without local knowledge, timeline delays from slow decision-making, and budget overruns from errors.

Remote investors typically achieve better outcomes working with local renovation managers like Casa Oeste who handle contractor relationships, quality oversight, and design decisions.

The cost of professional management (typically 10-15% of renovation budget) prevents errors that often exceed this in cost through poor contractor selection or design mistakes. You can learn more about our pricing structure here.

-

Lagos Old Town offers walkability to restaurants, bars, marina, and beaches within 5-15 minutes, serving multiple guest demographics year-round. Properties here command premium rates because guests avoid car dependency for daily activities. The location attracts summer families, shoulder-season couples, and winter long-stay visitors, supporting year-round occupancy. Not all Algarve locations offer this combination of walkability, year-round appeal, and concentrated international demand.

-

We manage renovation budgets through our in-house team, contractor agreements with trusted & established local relationships, detailed material specifications preventing costly changes mid-project, regular site inspections ensuring quality and schedule adherence, and proactive problem-solving when issues arise.

We maintain contractor relationships developed over years of local operation, allowing reliable execution and quality control. Our renovation timeline planning considers seasonal revenue capture—we schedule completion dates to maximize peak-season revenue in first operational year, recognizing that renovation timing directly impacts financial returns.

Want to see what your rental property in the Algarve should actually be earning?

Get your free earnings estimate using real Algarve market data.

✔ No obligation or commitment

✔ Hyper-local, conservative projections

✔ Analysis across 100+ performance factors

About the Author

Matt Deasy is the founder and CEO of Casa Oeste: a property expert with more than 20 years of experience in international tourism and 15 years living in the Western Algarve. Having renovated multiple properties across Portugal, Matt brings a practical, boots-on-the-ground perspective to every article.

He is the author of two books on relocating and investing in Portugal: Portugal Beckons and Your Portuguese Property Beckons, both available on Amazon.

Through Casa Oeste, Matt helps homeowners unlock the full potential of their Algarve properties with expert management, renovations, and market-led insights.